do nonprofits pay taxes on utilities

These organizations are required to pay the tax on all purchases of tangible personal property. The Illinois Department of Revenue has issued guidance to a taxpayer regarding exemptions for nonprofit organizations.

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping Chart Of Accounts Accounting Downloadable Resume Template

Taxes on money received from an unrelated business activity.

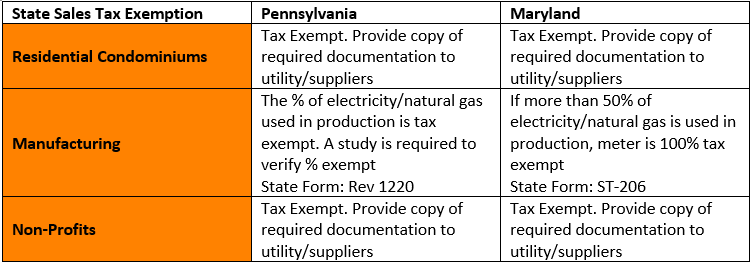

. House Bill 582 which legislates the tax exemption passed the House 121. Sales of utilities such as gas electricity telephone services telephone answering services and mobile telecommunications services. DLC must have a copy of the Pennsylvania Sales Tax Exemption certificate and the Pennsylvania Holding Exemption certificate on file if you are claiming status as a non-profit organization.

There are certain circumstances however they may need to make payments. Utility sales tax on items such as telephone gas electric or water that is used to further the tax exempt purpose for a nonprofit organization or government agency may be exempt from utility sales tax. In addition to the monthly tax-free sale affiliated student organizations do not have to collect sales tax on the first 5000 of their taxable sales in a calendar year.

Any nonprofit that hires employees will also. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions. In fact the company received cash refunds of 3514 million.

UBI can be a difficult tax area to navigate for non-profits. Under IRC 501c there are at least 29 different types of tax exempt organizations listed. It includes federal state and local income tax withholding requirements Social Security taxes and Medicare tax.

Nonprofits that will have employees should consult with an. Only incorporated nonprofits with IRS-issued tax exempt numbers can avoid paying taxes. Organizations that are subject to the 5 state sales or use tax may also be subject to the.

A 05 county sales or use tax b 01 baseball stadium sales or use tax c local exposition taxes and d 05 125 for the City of Wis-consin Dells and. 501c3s do not have to pay federal and state income tax. As non-profit enterprises cooperatives do not pay income taxes.

A 501c3 operating in Illinois may not have to pay Illinois sales tax and it may exempt from real estate taxes on property it owns. Even though the federal government awards federal tax-exempt status a state can require additional documentation to. Due to an emergency clause in this legislation sales of admissions and tangible property sales at fundraising events by all nonprofit groups and governmental organizations are now exempt from sales tax for transactions on or after March 26 2019.

A spokesman Ed Legge said the refunds resulted from a failed energy trading business. To be tax exempt most organizations must apply for recognition of. The one most universally recognized is 501c3 which is primarily related to religious charitable scientific and educational purposes.

However this corporate status does not automatically grant exemption from federal income tax. According to the Michigan tax code at the time of publication churches schools charities eligible hospitals and other nonprofit organizations are exempt from state sales tax on regulated electric natural gas and telecommunication bills. Once a nonprofit has incorporated and received its tax exempt number it is automatically exempt from corporate income tax only.

For example renting office. The four events. Non-profit exemption A qualifying non-profit organization pays no sales tax on the electricity use.

Employment tax is an umbrella term capturing a range of distinct tax regimes. OK the operating principle behind a non-profit is that there is very little profit if any at the end of the year. Very often the only taxes we do not pay are property taxes.

Nonprofits are also exempt from paying sales tax and property tax. All other tax breaks and incentives including property tax have to be applied for individually. While the income of a nonprofit organization may not be subject to federal taxes nonprofit organizations do pay employee taxes.

Effective Sunday churches will no longer have to pay sales tax on utilities including electricity water and natural gas. Nonprofit senior citizens groups can hold four tax-free sales events each calendar year. Taxability of rental income is fact-and-circumstance driven so.

For the most part nonprofits are exempt from most individual and corporate taxes. Below is a beginners guide intended for high-level determination of whether rental income is subject to unrelated business income tax reporting for tax-exempt entities under Internal Revenue Code Section 501 c 3. Like all employers a nonprofit must pay the taxes associated with its payroll.

The research to determine whether or not sales tax is due lies with the nonprofit. Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction. Also very often they depend on donations for sustenance and upkeep instead of selling items for a profit.

Four Tax-Free Fundraising Events a Year. Exempt Organizations Liable for Excise Taxes on Utilities in Illinois. But they do have to pay.

You do not have to collect sales tax on sales to an organization that is exempt from having to pay sales tax but you. It is important to contact each utility in. But the money did not go to the government.

When nonprofit organizations engage in selling tangible personal property at retail they are required to comply with provisions of the Act relating to collection and remittance of the tax. Prior to February 2019 these customers seeking a utility sales tax exemption were required to complete Form ST-200 to receive an ST-109. These nonprofit governmental and civic organizations will no longer charge sales tax on these types of.

Effective Sunday churches will no longer have to pay sales tax on utilities including electricity water and natural gas. Income tax is the only tax electric cooperatives are not required to pay. New Sales-Tax Rules for Nonprofits.

These taxes support local schools police and fire departments roads and government services. Nonprofit organizations that receive an exemption identification number E number from the Department are exempt from state sales and use tax when. Answer 1 of 2.

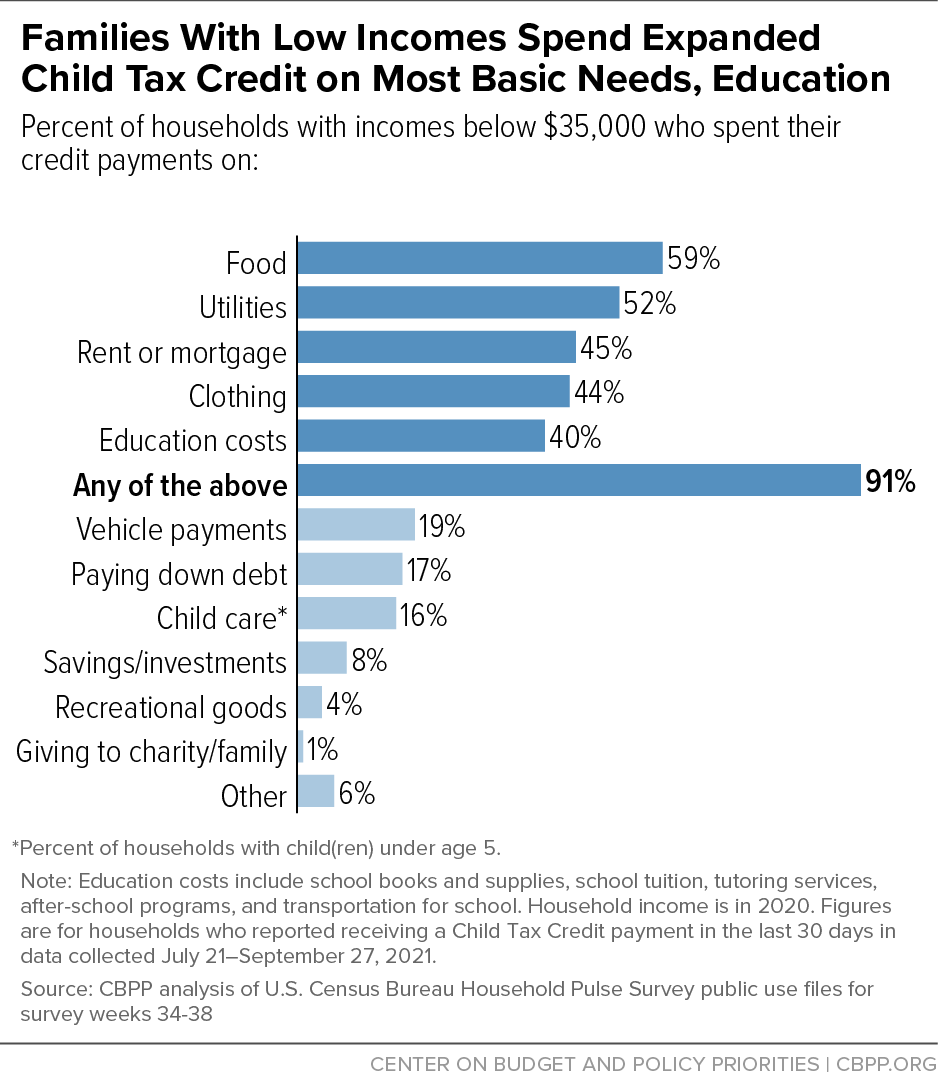

Focusing on 501c3 entities for state sales tax Do nonprofits pay taxes. Federal Tax Obligations of Non-Profit Corporations. For example if your nonprofit earns any income from activities unrelated to its purpose it will owe income taxes on that amount.

Co-ops pay property tax sales tax gross receipts tax ad valorem tax unemployment tax and payroll tax. Employment taxes on wages paid to employees and. Customers paid Xcel Energy a big utility in 10 Midwest and Western states at least 723 million to cover taxes from 2002 to 2004.

Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax. 501c3s do not have to pay federal and state income tax. Which Taxes Might a Nonprofit Pay.

This results in significant savings on monthly utility bills.

Tax Exemptions For Energy Nania

Free Cash Flow Forecast Templates Smartsheet Cash Flow Budget Forecasting Personal Finance Budget

Payment Kiosks For Utilities And Government Citybase

Tweets With Replies By Ripplenami Uganda Ripplenamiu Twitter

Utility Payment Plans Utility Payments And Services Citybase

Estes Sees Sales Tax Revenue Bounce Back In A Big Way Estes Park Trail Gazette

Providing Essential Utility Services During Covid 19 Payments And Relief

Pdf Tax Pyramiding The Economic Consequences Of Gross Receipts Taxes Semantic Scholar

Utility Users Tax Public Agency Accounts Spurr

September Sales Tax Up From 2019 Estes Park Trail Gazette

Danilo Leandro Trisi Trisidanilo Twitter

Grant Proposal Checklist Template Budget Template Budgeting Checklist Template

Readablebest Of Sales Tax Worksheet Salestaxbycity Salestaxdecalculator Salestaxharyana Budgeting Worksheets Budget Spreadsheet Budget Spreadsheet Template

Houston Utility Assistance Find Help To Pay Your Light Bill

Electric Utilities Sector Supplement Global Reporting Initiative

Nevada Commercial Lease Agreement Form Lease Agreement Legal Forms Lease